Correlation between currency pairs, price developments

and indicators are thought a trader has to give consideration to.

Another consideration in trading currencies is the

spread between the buying price and the selling price.

Purpose of

this post

The purpose is to give some examples and a general

idea of currency pairs with different spreads.

The content is only illustrative.

What is a

spread between the buying and selling price

A spread is the pips between the price the currency pairs are brought at and the price they are sold

at.

Why look

at the spread

The wider the spread is the longer it will take to get

profit.

Currency

pairs with different spreads

Examples of different currency pairs with different

spreads; the prices and the spreads are from the 18 of December 2013 from one

of the trading platforms; the spreads could vary from other trading platforms.

Currency

pairs with a 2 pips spread

|

EUR/USD

|

1,3741

|

1,3743

|

|

AUD/USD

|

0,8904

|

0,8906

|

|

USD/JYP

|

103,06

|

103,08

|

Currency

pairs with a 3 pips spread

|

EUR/JYP

|

141,60

|

141,63

|

|

NZD/USD

|

0,8246

|

0,8249

|

Currency

pairs with a 4 pips spread

|

EUR/CHF

|

1,2205

|

1,2209

|

|

EUR/AUD

|

1,5430

|

1,5434

|

|

USD/CHF

|

0,8880

|

0,8884

|

|

GBP/USD

|

1,6376

|

1,6380

|

Currency

pairs with a 5 pips spread

|

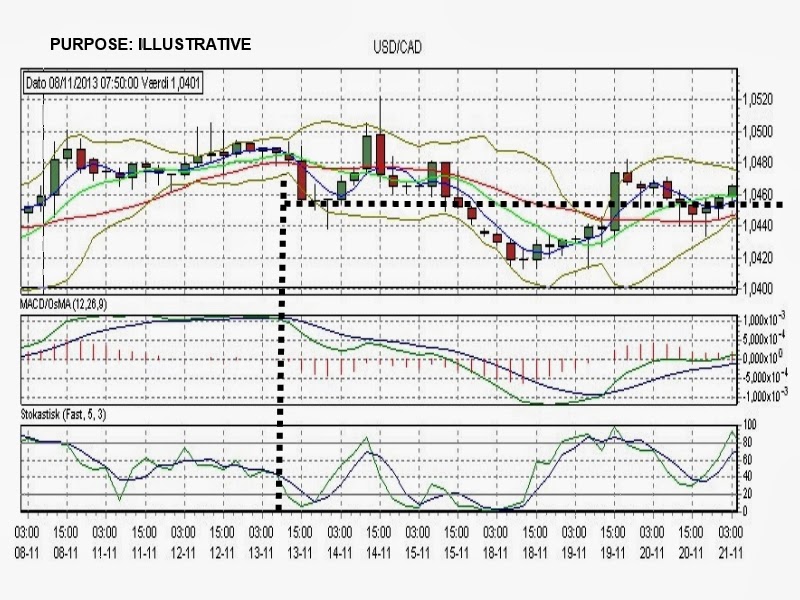

USD/CAD

|

1,0642

|

1,0647

|